Withholding Tax

Overview

Withholding tax is filed on an as-needed basis in accordance with established regulations.

To access the Withholding tax form, navigate to Tax Form.

Submit a withholding tax form

-

Verify that the values in the following fields are correct:

- Tax Identification Number — automatically populated based on the selected TIN.

- Taxpayer Name — automatically populated with the registered name associated with the selected TIN.

-

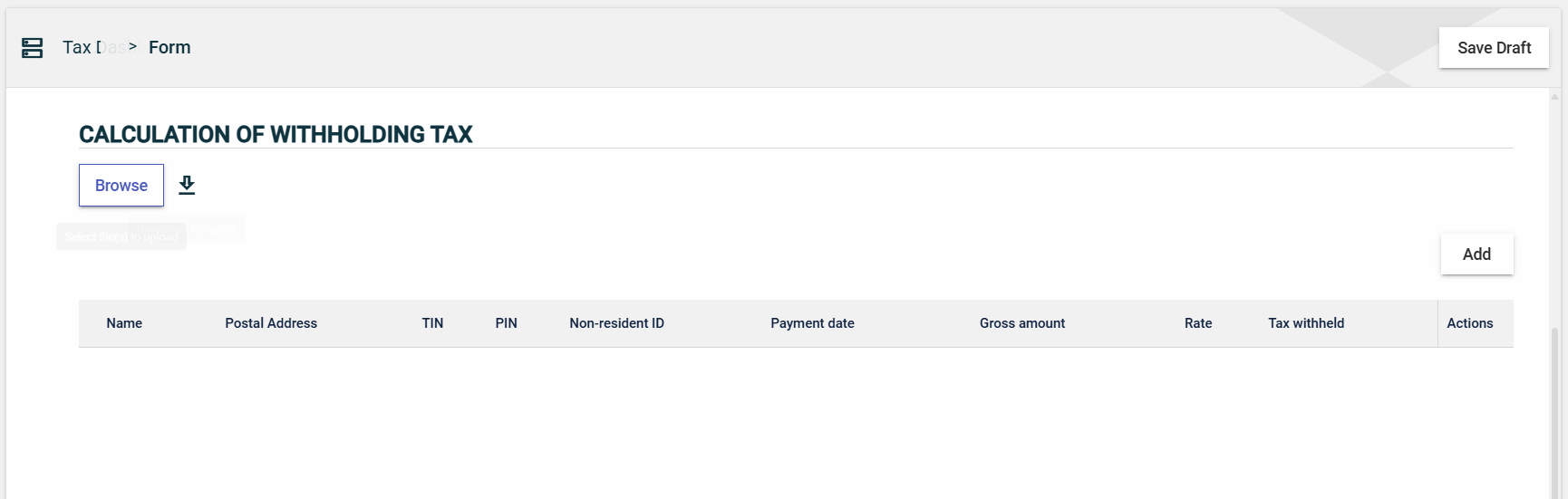

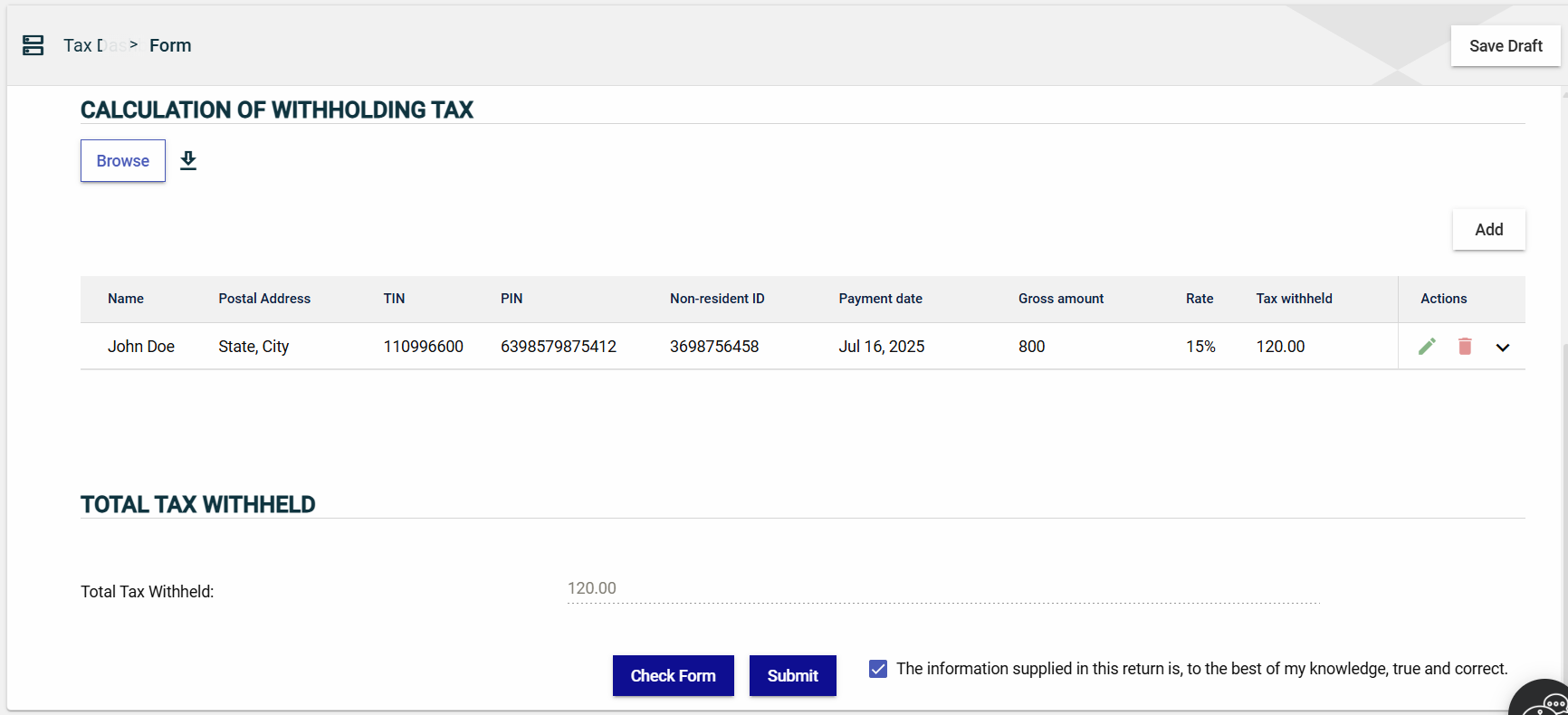

Click the Add button in the CALCULATION OF WITHHOLDING TAX section. There is no limit to the number of rows.

-

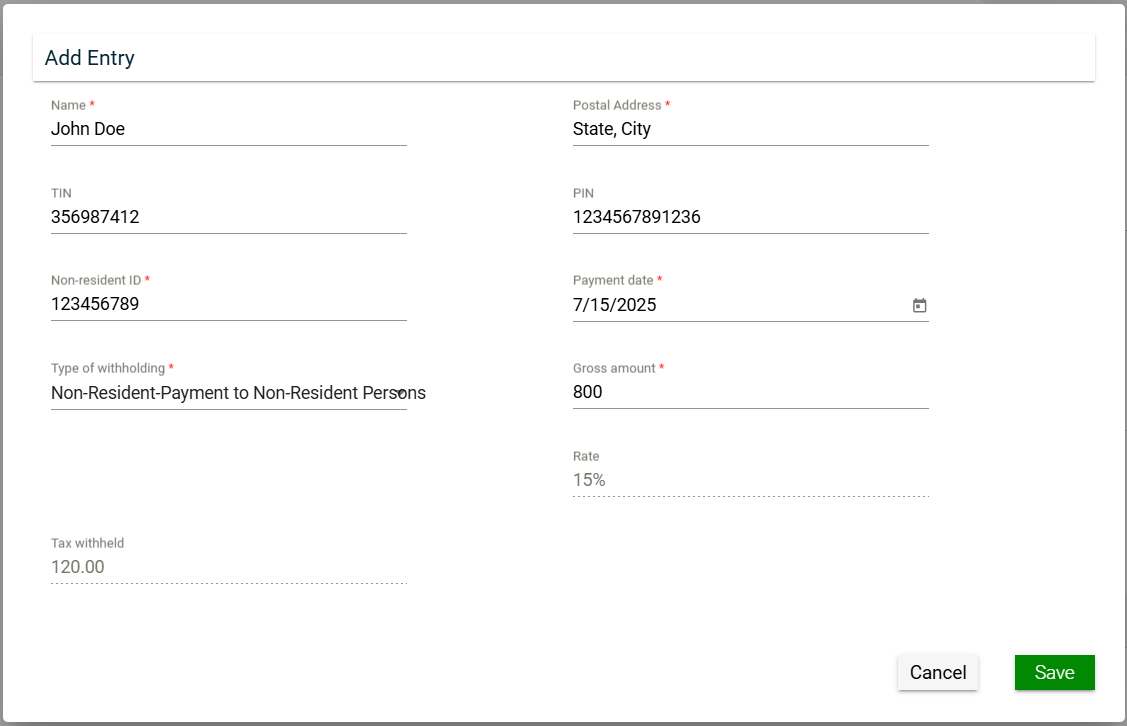

An Add Row popup window is displayed.

-

Enter valid values in the following mandatory fields:

- Name

- PIN — If you are a resident, Enter your 13-digit PIN in the PIN field. Otherwise, enter your passport ID number in the Non-resident ID field.

- TIN

- Postal Address

- Non-resident ID — If you are not a resident, enter your passport ID number in the Non-resident ID field. Otherwise, enter your 13-digit PIN in the PIN field.

- Payment date

- Type of withholding

- Gross amount

- Click the Save button.

-

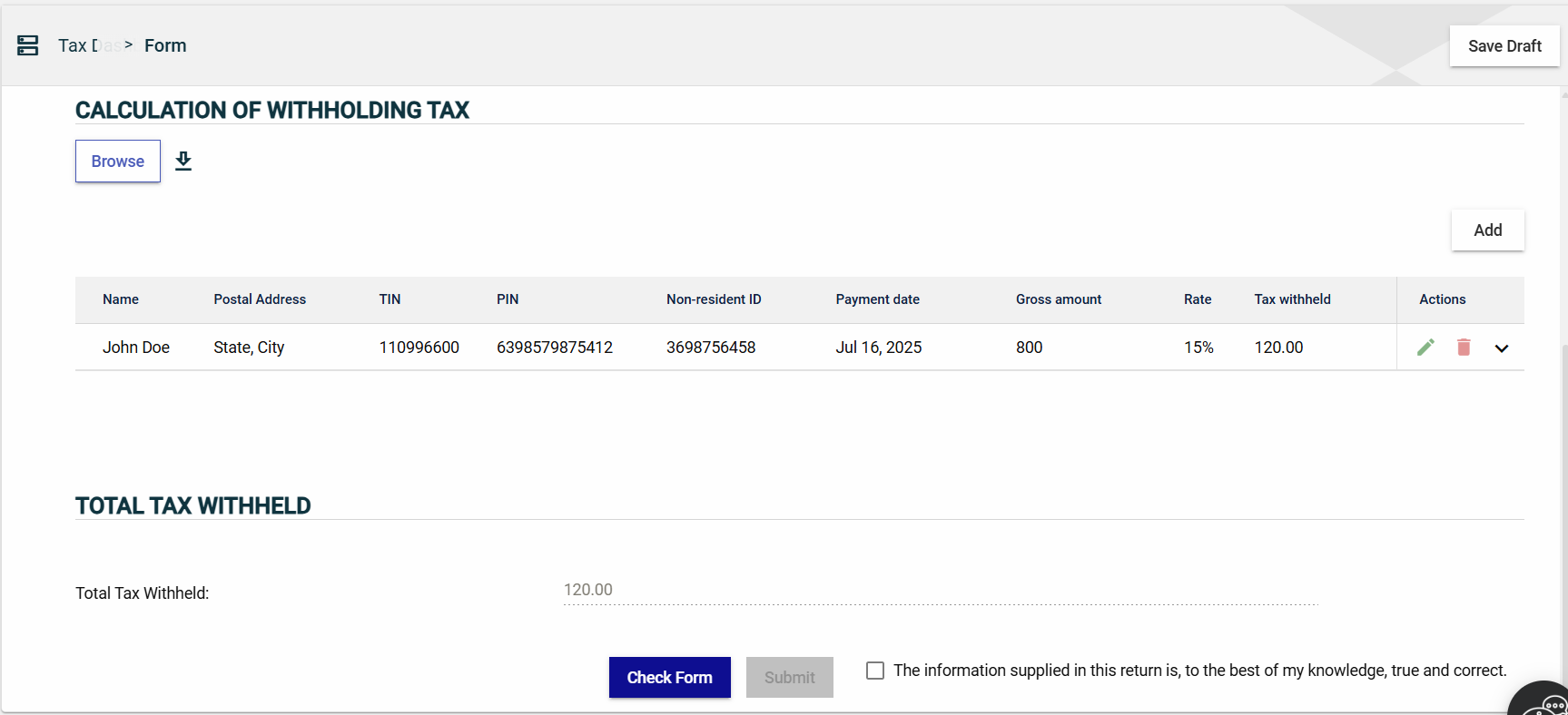

Ensure that the Total Tax Withheld field displays the sum of all the values in the Tax withheld column in the CALCULATION OF WITHHOLDING TAX section.

-

Click Check Form to validate the filled-in form.

-

Tick the checkbox to confirm that the information you provided is true and correct. Checking the box will enable the Submit button.

-

Click Submit.

Save a draft

You can now save a draft of the filled-out tax form by clicking the Save Draft button at any time before submitting it.

Pending status.