Value Added Tax Return

Overview

Businesses and national or public institutions producing taxable goods are required to pay a Value Added Tax (VAT) Return. However, diplomats and some NGOs are exempted from VAT.

It is the responsibility of taxpayers to submit a VAT form declaring the total value of purchases and sales for all goods. All VAT returns must be filed online.

The VAT tax rate is set at 15% for all taxpayers.

To access the VAT Return form, navigate to Tax Form.

Submit a VAT Return form

- Verify that the values in the following fields are correct:

- Tax Identification Number — automatically populated based on the selected TIN.

- Taxpayer Name — automatically populated with the registered name associated with the selected TIN.

- Select a date in the Period End Date dropdown list that shows all due dates of tax obligations associated with the entered TIN.

- Add output tax items. The following are the two ways to add a withholding tax item:

- Add an output tax item manually.

- Upload a file by clicking the Output Upload Schedule button.

- Add input tax items. The following are the two ways to add a withholding tax item:

- Add an input tax item manually.

- Upload a file by clicking the Input Upload Schedules button.

- Click the Adjustment Justification button to select files to support your declared adjustments.

- A Files button will be displayed. Click the Files button.

- Review the selected files. To review an uploaded file, click

.

.

To delete an uploaded file, click .

. - Click Upload.

- The VAT Payable/Refundable field is automatically populated with the difference between the Output Tax and Input Tax.

- Choose whether you prefer your VAT refund to be carried forward to set off future liability.

- Click Check Form to validate the filled-in form.

If errors are found, an error message is displayed. Correct the errors before clicking Check Form again to enable the checkbox. - Tick the checkbox to confirm that the information you provided is true and correct. Checking the box will enable the Submit button.

- Click Submit.

500, the app will not process it. Instead, it will remain in your VAT account as a credit, which can be applied to future VAT liabilities.

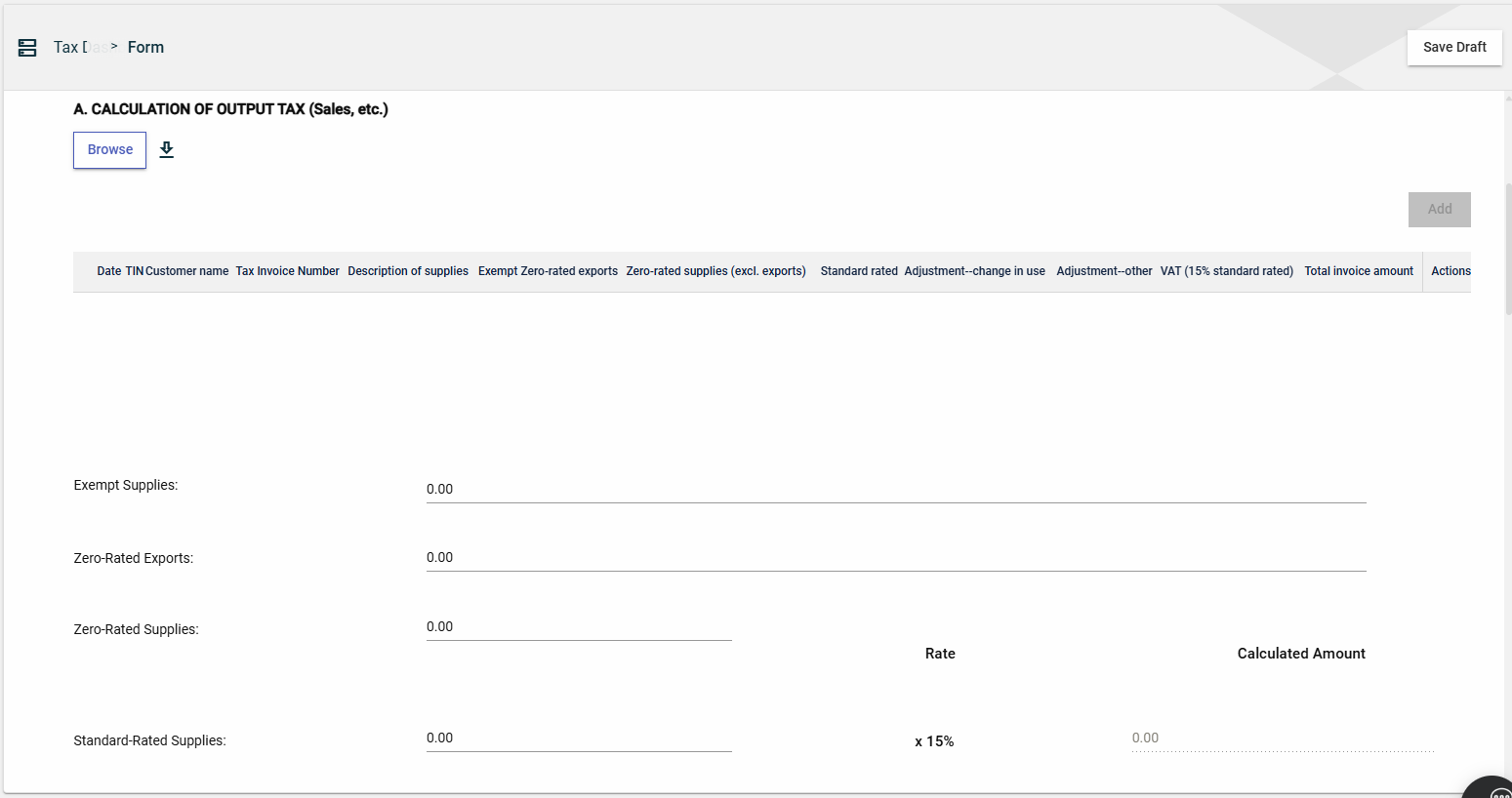

Add an output tax item

- Click the Browse button in the CALCULATION OF OUTPUT TAX (Sales, etc.) section.

- A file explorer popup window is displayed.

- Select the output tax item.

- Click the Open button.

Once you have added an item, it will be displayed in a table. Each item will have its own row, displaying important information. To edit the details, click ![]() . To remove an item, click

. To remove an item, click ![]() .

.

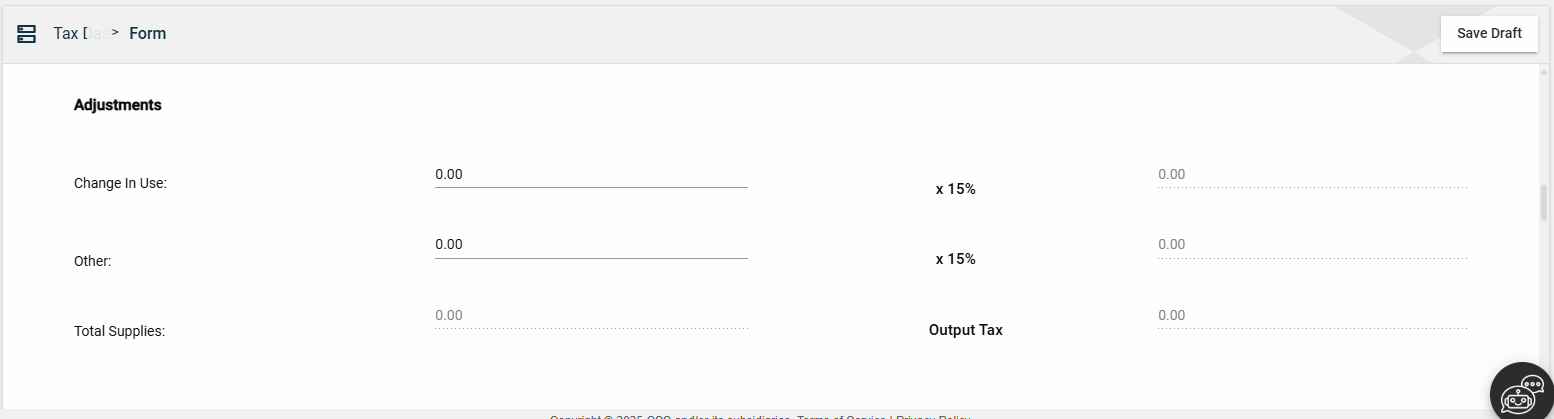

Notes:

- The Calculated Amount column is automatically populated with the product of the field value and

15%. - The Total Supplies field is automatically populated with the sum of all output tax rates and adjustments.

- The Output Tax field is automatically populated with the sum of all values in the Calculated Amount column.

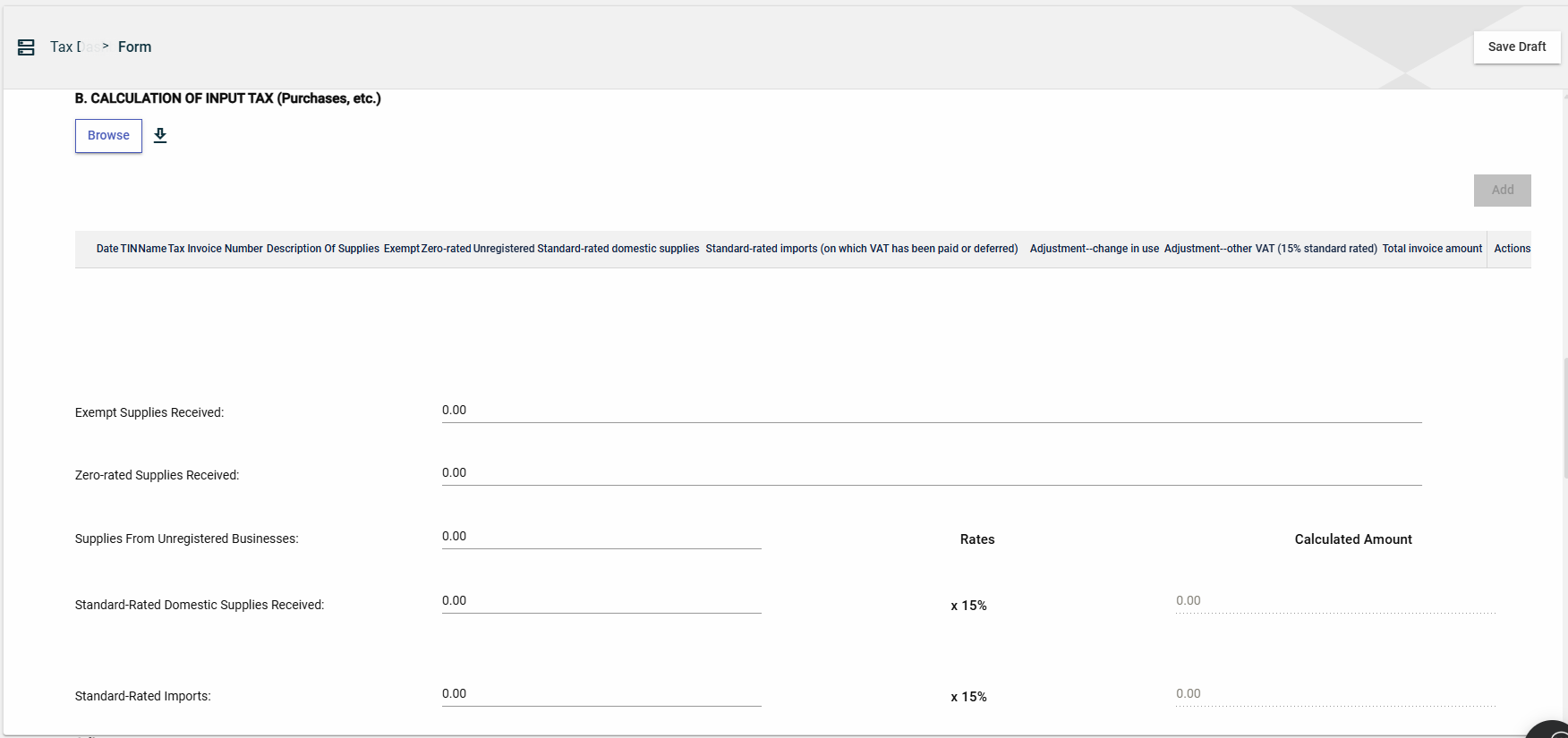

Add an input tax item

- Click the Browse button in the CALCULATION OF OUTPUT TAX (Sales, etc.) section.

- A file explorer popup window is displayed.

- Select the output tax item.

- Click the Open button.

Once you have added an item, it will be displayed in a table. Each item will have its own row, displaying important information. To edit the details, click ![]() . To remove an item, click

. To remove an item, click ![]() .

.

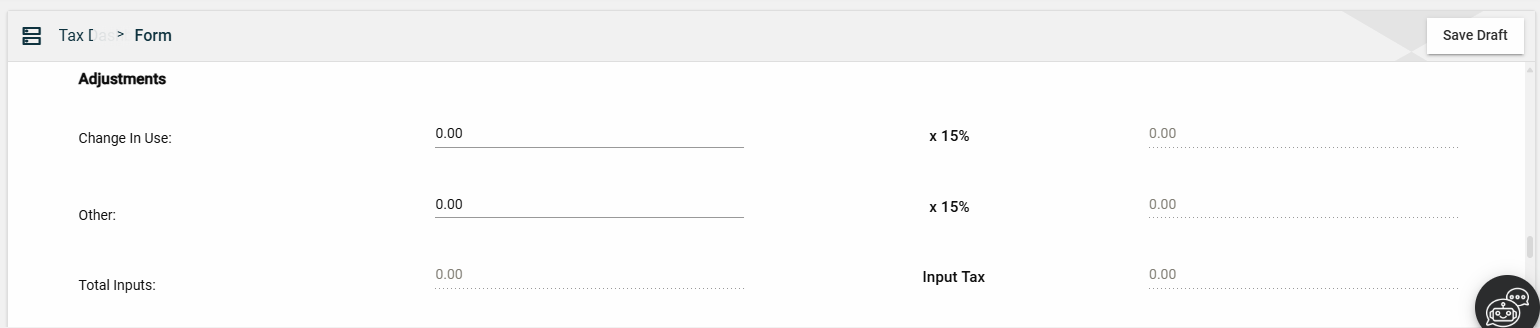

Notes:

- The Calculated Amount column is automatically populated with the product of the field value and

15%. - The Total Inputs field is automatically populated with the sum of all output tax rates and adjustments.

- The Input Tax field is automatically populated with the sum of all values in the Calculated Amount column.

Save a draft

You can now save a draft of the filled-out tax form by clicking the Save Draft button at any time before submitting it.

Pending status.