Pay As You Earn

Overview

Pay as you earn (PAYE) tax is a type of self-assessed tax in which an employer is responsible for declaring and paying income tax for all its employees. The employer is required to fill and submit PAYE tax forms that contain information such as income, fringe benefits, and other relevant details.

The following are the applicable tax rates:

| Taxable amount condition | Tax Rate |

|---|---|

| Less than E100000 | E0 + 20% of the excess over E0 |

| Equal or greater than E100000 but less than E150000 | E20000 + 25% of the excess over E100000 |

| Equal or greater than E150000 but less than E200000 | E32500 + 30% of the excess over E200 000 |

| Equal or greater than E200000 | E47500 + 33% of the excess over E200000 |

To access the PAYE tax form, navigate to Tax Form.

Submit a PAYE tax form

- Verify that the values in the following fields are correct:

- Tax Identification Number — automatically populated based on the selected TIN.

- Taxpayer Name — automatically populated with the registered name associated with the selected TIN.

-

Select a date in the Period End Date dropdown list that shows all due dates of tax obligations associated with the entered TIN.

-

Enter valid values for No. of Employees and No. of PAYE Employees fields.

-

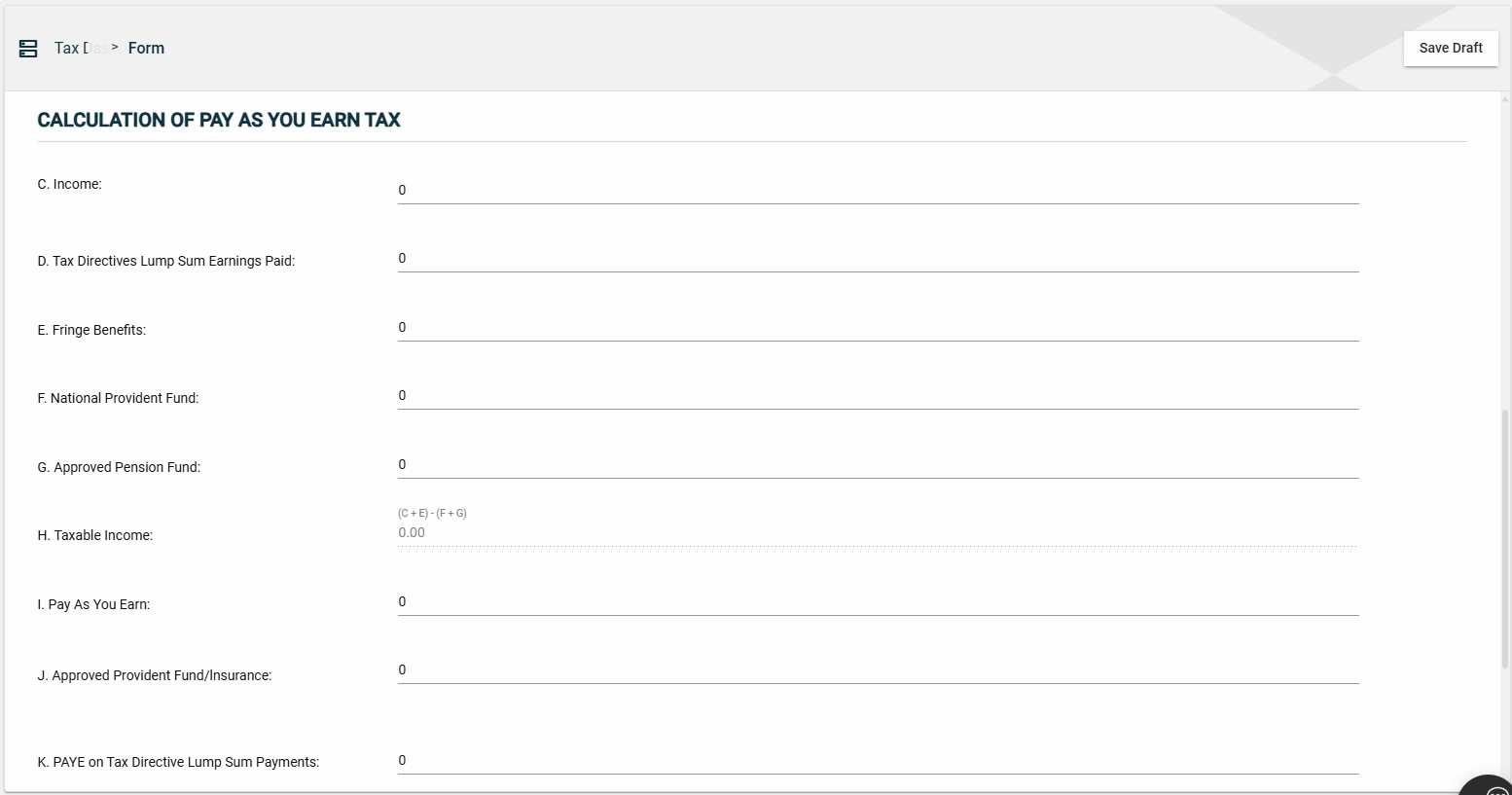

Enter valid values in the following mandatory fields in the CALCULATION OF PAY AS YOU EARN TAX section:

- Income

- Tax Directives Lump Sum Earnings Paid

- Fringe Benefits

- National Provident Fund

- Approved Pension Fund

- Taxable Income — automatically populated with the value that is calculated as follows:

Taxable Income= (Income+Fringe Benefits) - (Swaziland National Provident Fund + Approved Pension Fund) - Pay As You Earn

- Approved Provident Fund/Insurance

- Graded Tax

- Approved Provident Fund/Insurance

- Tax on directive Lump Sum Payments

-

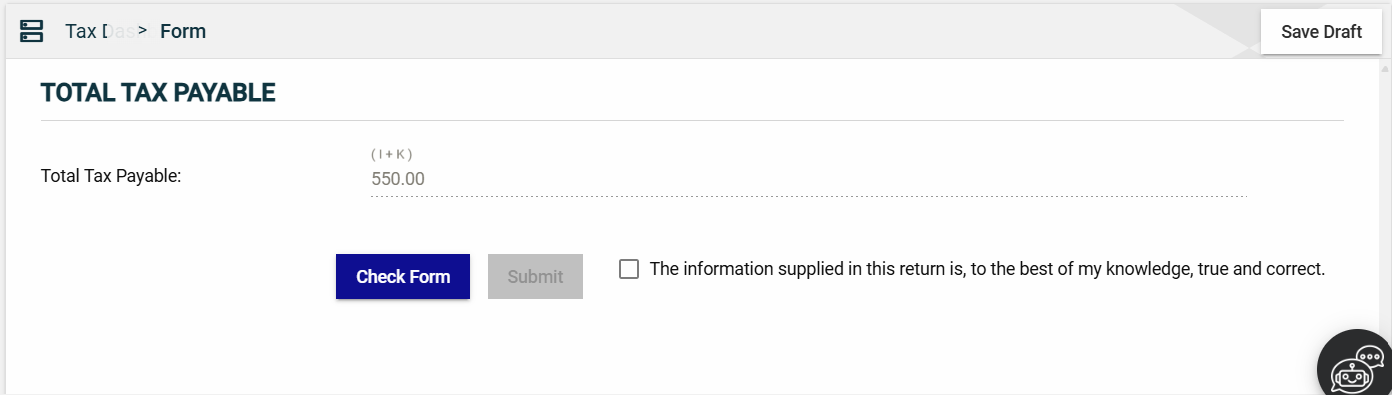

The Total Tax Payable field is automatically populated with the sum of

Pay As You Earn,Graded Tax, andTax on Directive Lump Sum Payments.

-

Click Check Form to validate the filled-in form.

If errors are found, an error message is displayed. Correct the errors before clicking Check Form again to enable the checkbox.

-

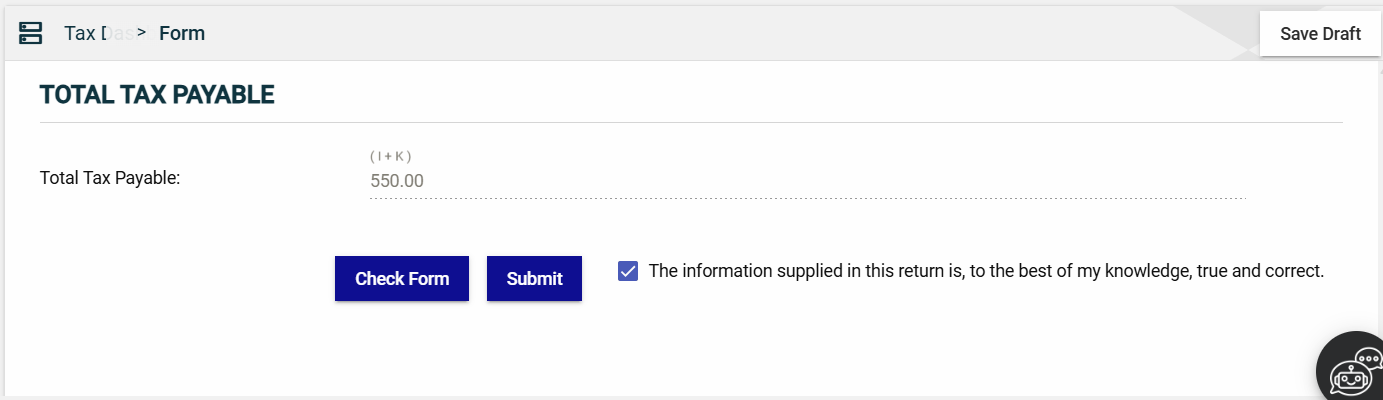

Tick the checkbox to confirm that the information you provided is true and correct. Checking the box will enable the Submit button.

-

Once ticked, the Submit button is enabled. Click Submit.

Save a draft

You can now save a draft of the filled-out tax form by clicking the Save Draft button at any time before submitting it.

Pending status.