Alcohol and Tobacco

Overview

Taxes are imposed on alcohol and tobacco due to their harmfulness to the health of individuals and society as a whole. Alcohol and tobacco taxes aim to discourage individuals and reduce the consumption of these harmful products.

To access the Alcohol and Taxes tax form, navigate to Tax Form.

Submit an Alcohol and Tobacco tax form

-

Verify that the values in the following fields are correct:

- Tax Identification Number — automatically populated based on the selected TIN.

- Taxpayer Name — automatically populated with the registered name associated with the selected TIN.

-

Select a date in the Period End Date dropdown list that shows all due dates of tax obligations associated with the entered TIN.

-

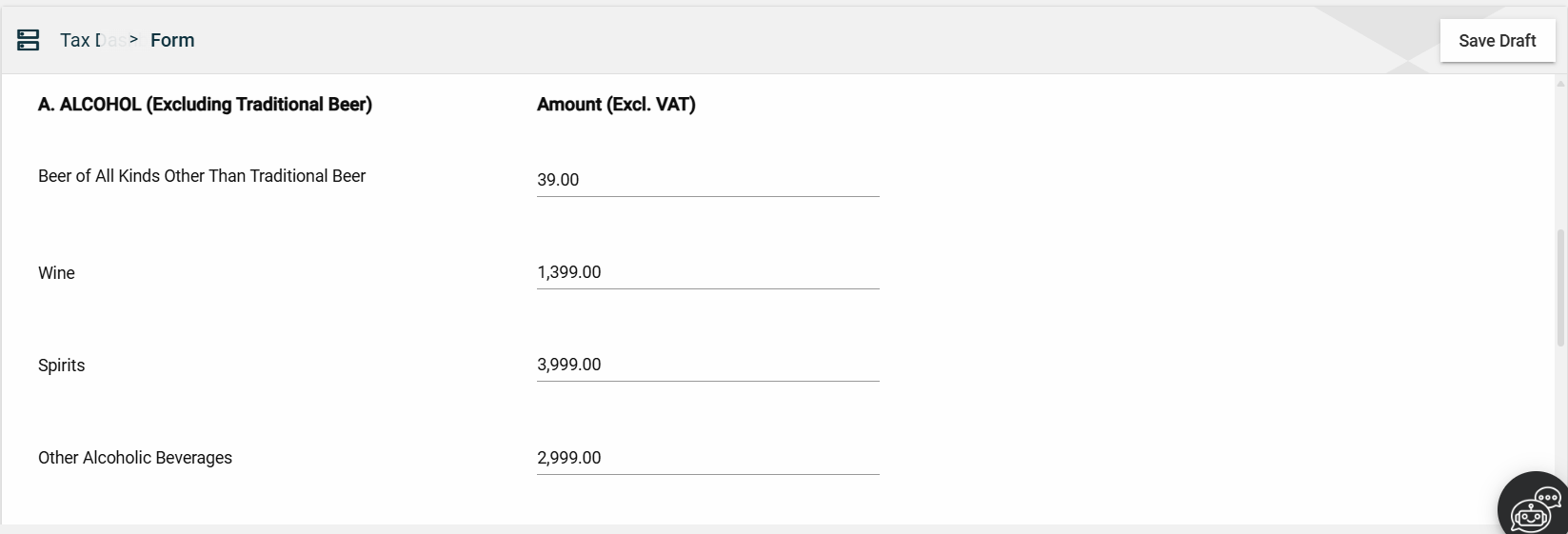

Enter valid values in the following mandatory fields:

- Beer of All Kinds Other Than Traditional Beer

- Wine

- Spirits

- Other Alcoholic Beverages

-

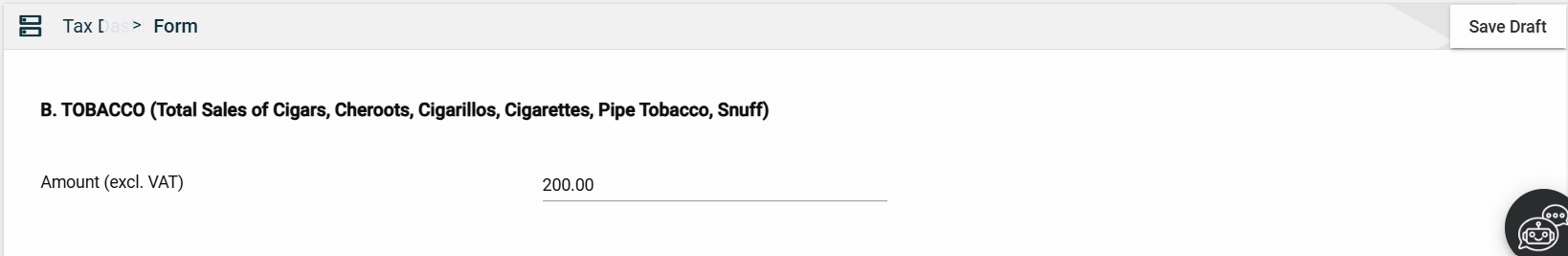

Enter valid values in the Amount(excl. VAT) field:

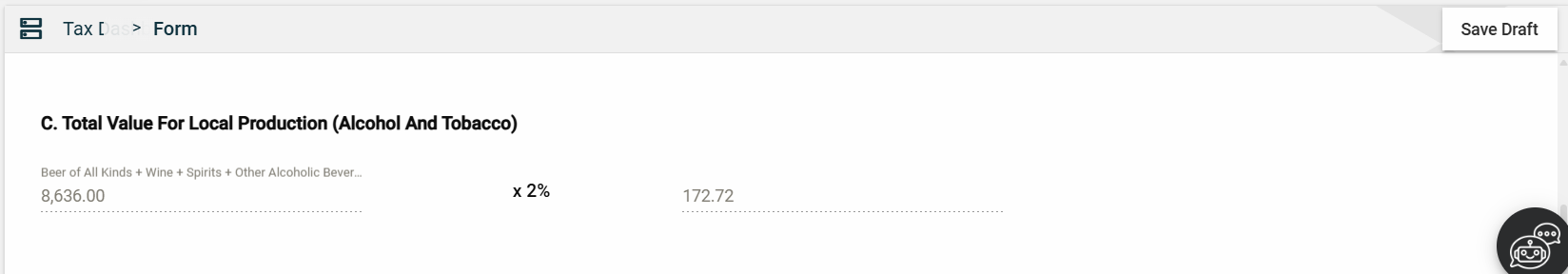

The Beer of All Kinds + Wine + Spirits + Other Alchoholic Beverages + Tobacco field is automatically populated with the sum of all values entered in the ALCOHOL and TOBACCO sections plus an additional two percent of the total values.

The Beer of All Kinds + Wine + Spirits + Other Alchoholic Beverages + Tobacco field is automatically populated with the sum of all values entered in the ALCOHOL and TOBACCO sections plus an additional two percent of the total values.

-

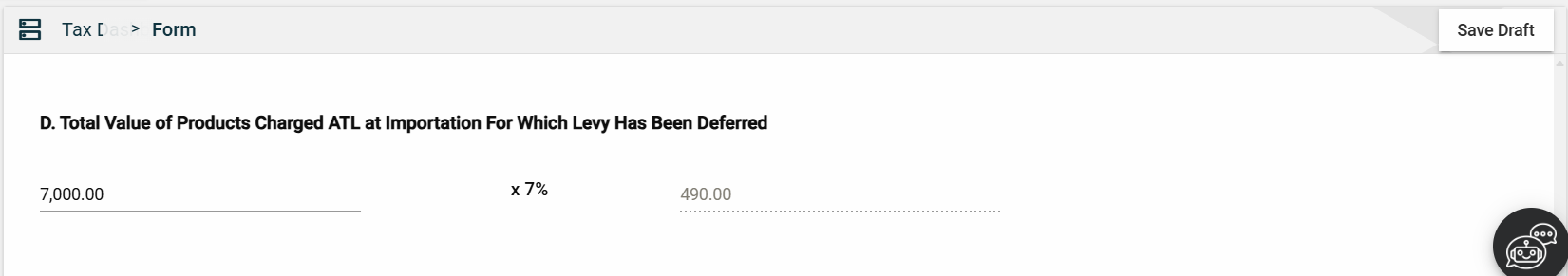

Enter valid values in the left field under theTotal Value of Products Charged ATL at Importation For Which Levy Has Been Deferred section.

The next field displays an additional two seven percent of the value entered in the previous field.

-

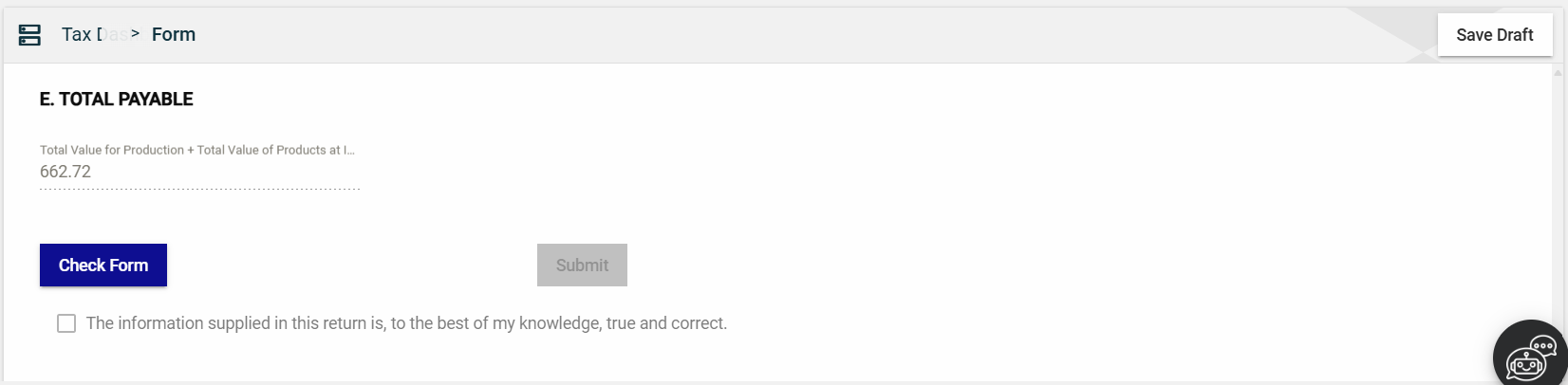

The Total Value of Production + Total Value of Products Charged ATL at Importation For Which Levy Has Been Deferred field is automatically populated.

-

Click Check Form to validate the entered information.

- Once validated, the Submit button will be enabled. Click Submit.

Save a draft

You can now save a draft of the filled-out tax form by clicking the Save Draft button at any time before submitting it.

Pending status.