Unfiled Obligations

Overview

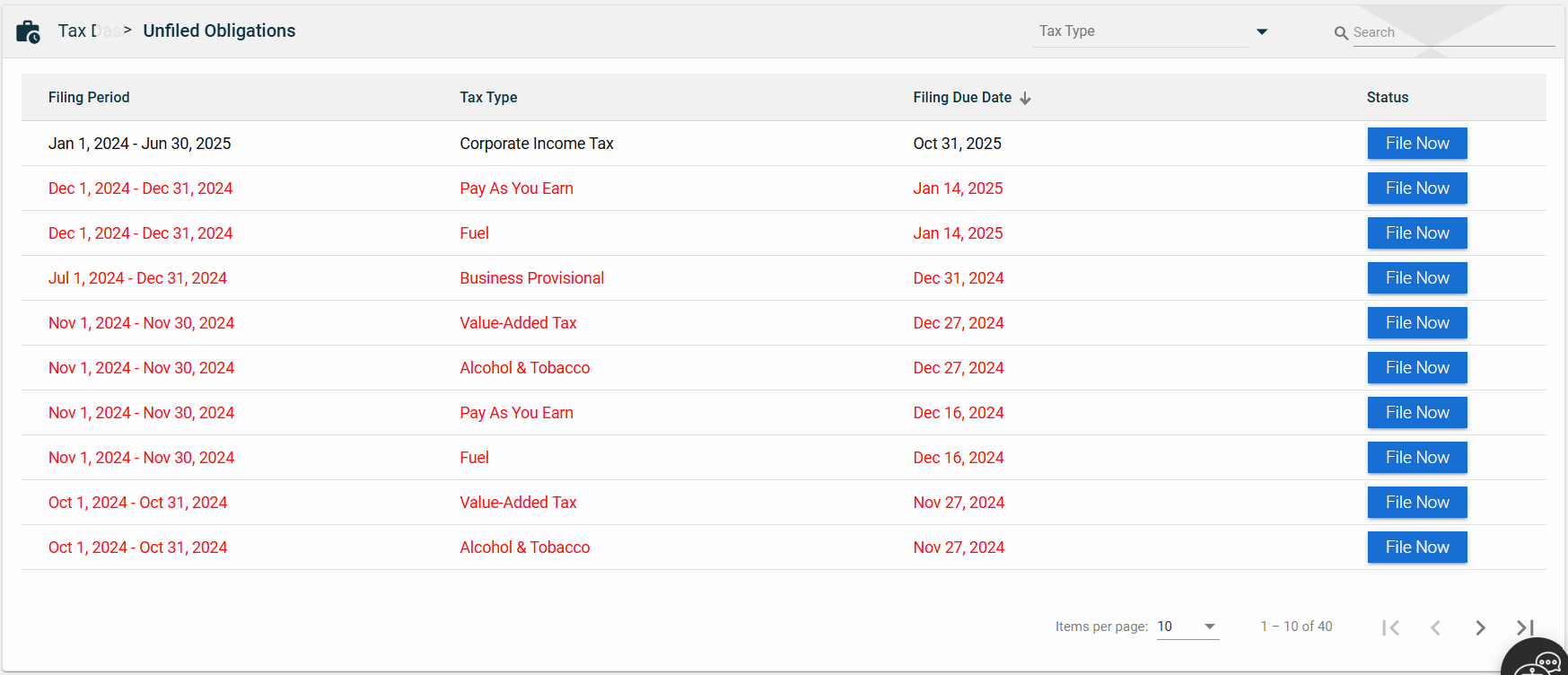

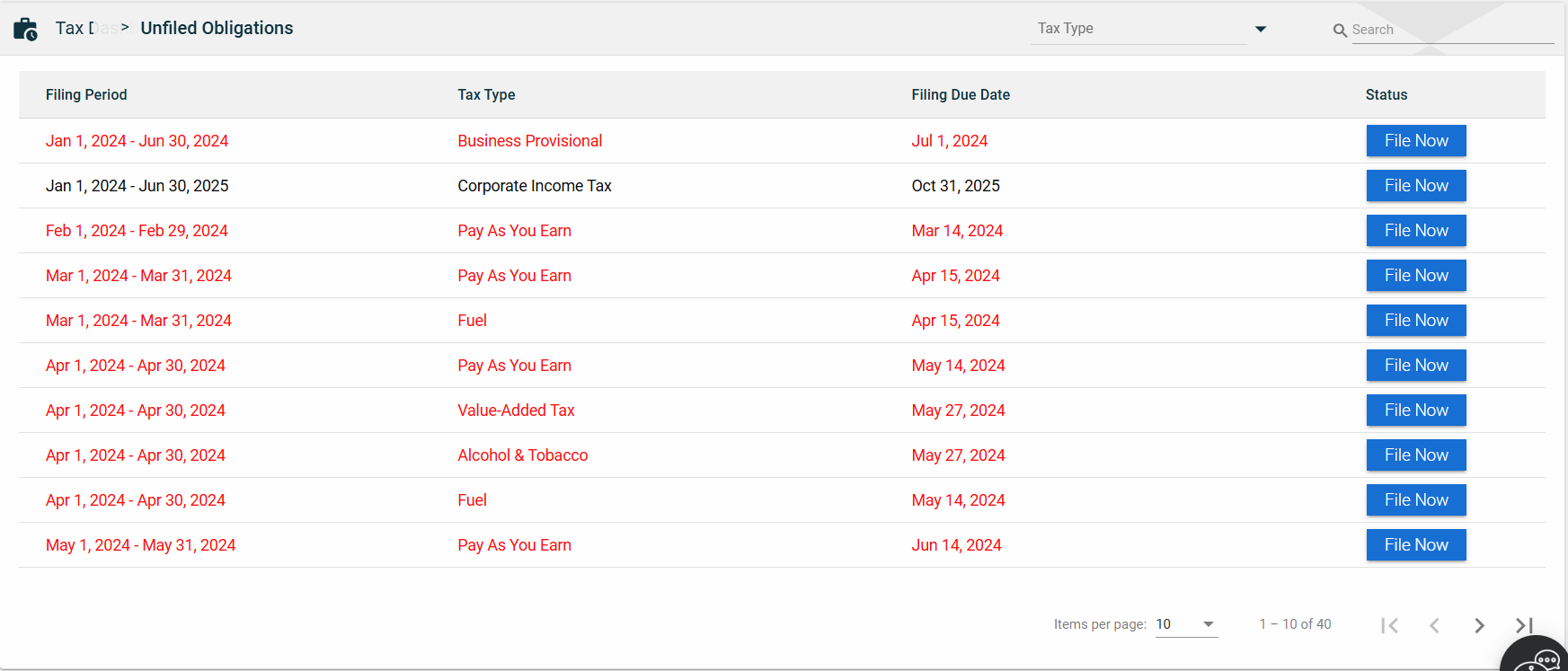

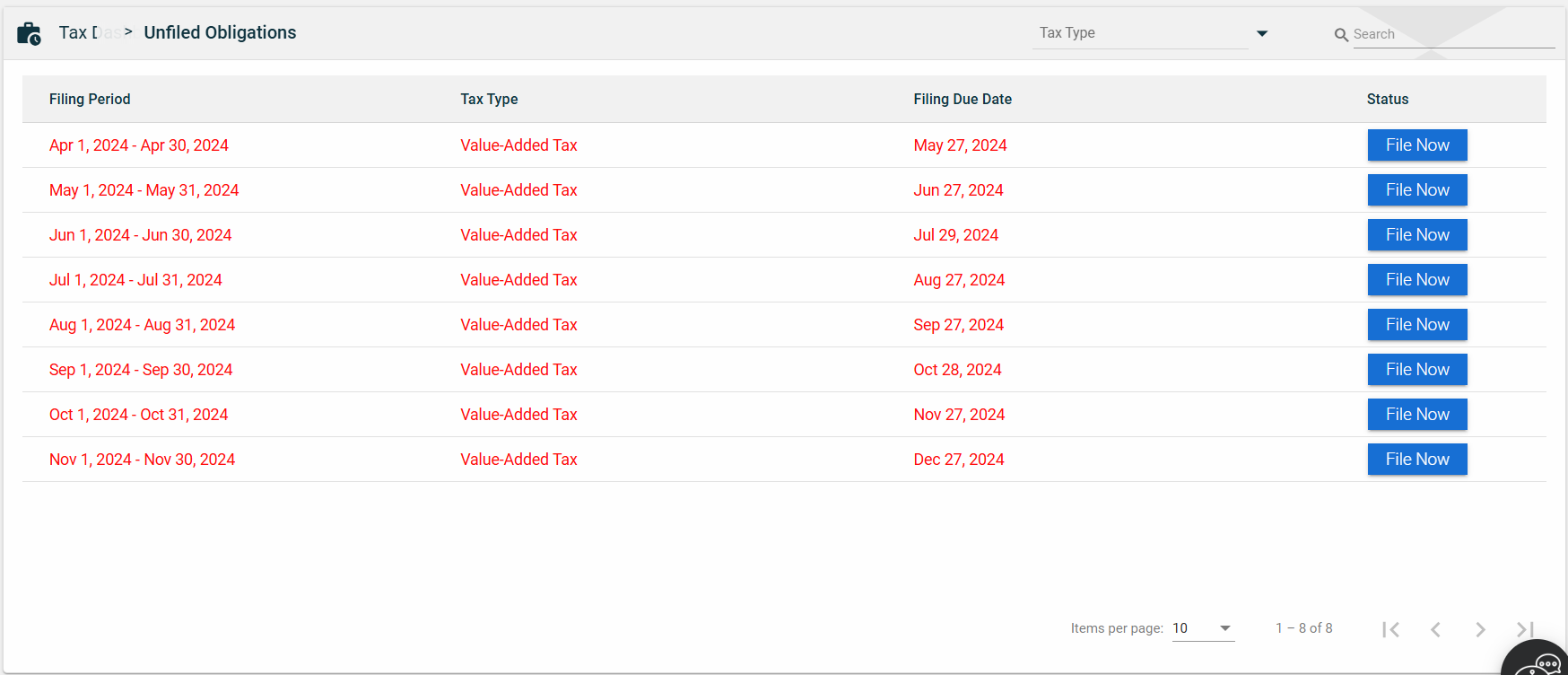

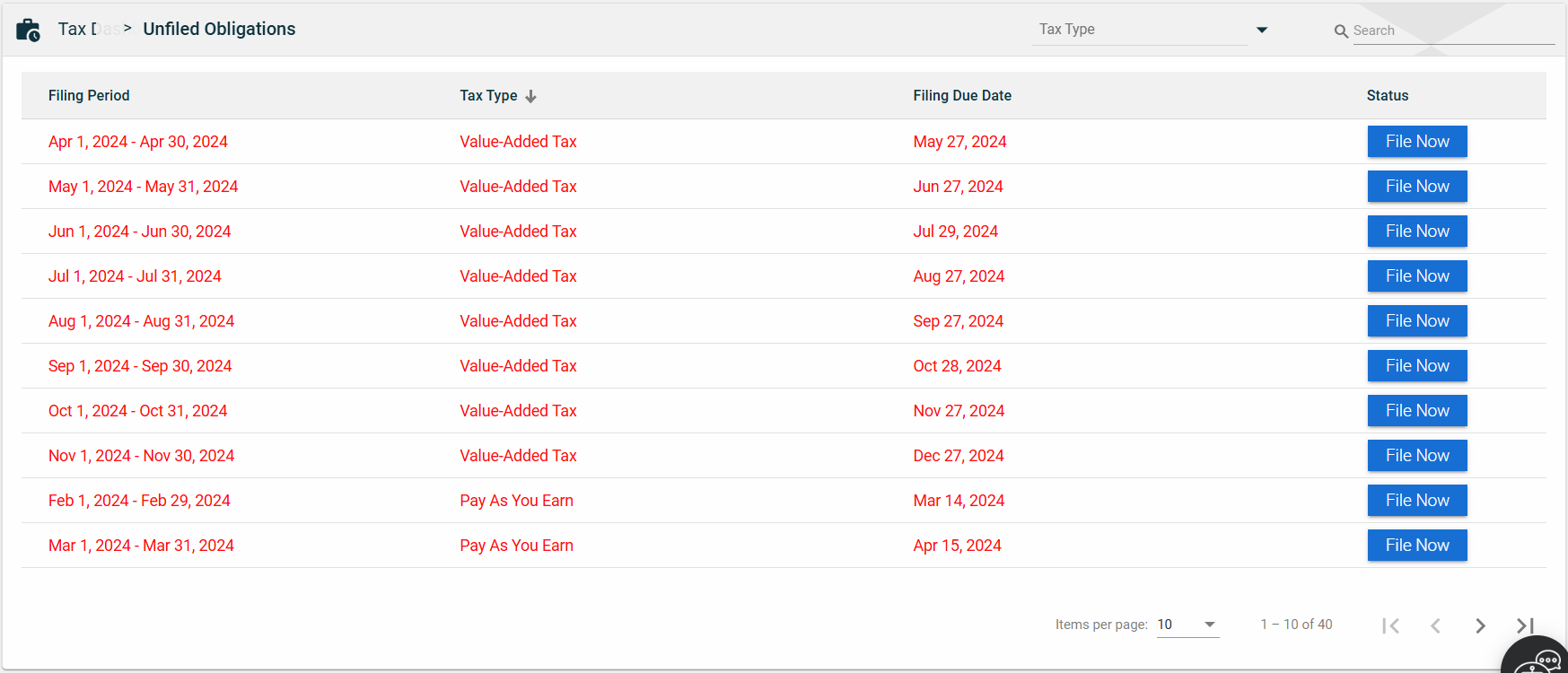

The Unfiled Obligations page lists all the Tax Forms filings that require submission. This page provides detailed information, such as the tax type and filing due date, and allows you to file the required tax forms in the portal. It is essential to ensure that all filings are submitted on time and in compliance with the tax laws and regulations.

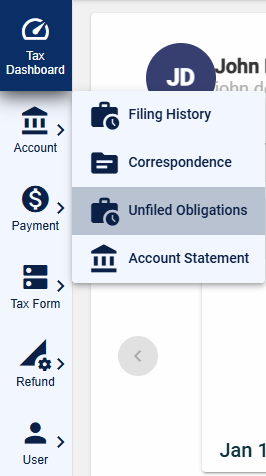

To access the Unfiled Obligations page, navigate to Account > Unfiled Obligations.

View

| Field | Description |

|---|---|

| Filing Period | Start and end date duirng which you incurred taxes. |

| Tax Type | Tax type you need to submit. |

| Filing Due Date | Last day of submitting the tax form. |

| Status | Displays the File Now button that, when clicked, will direct you to the Tax Form you need to submit. |

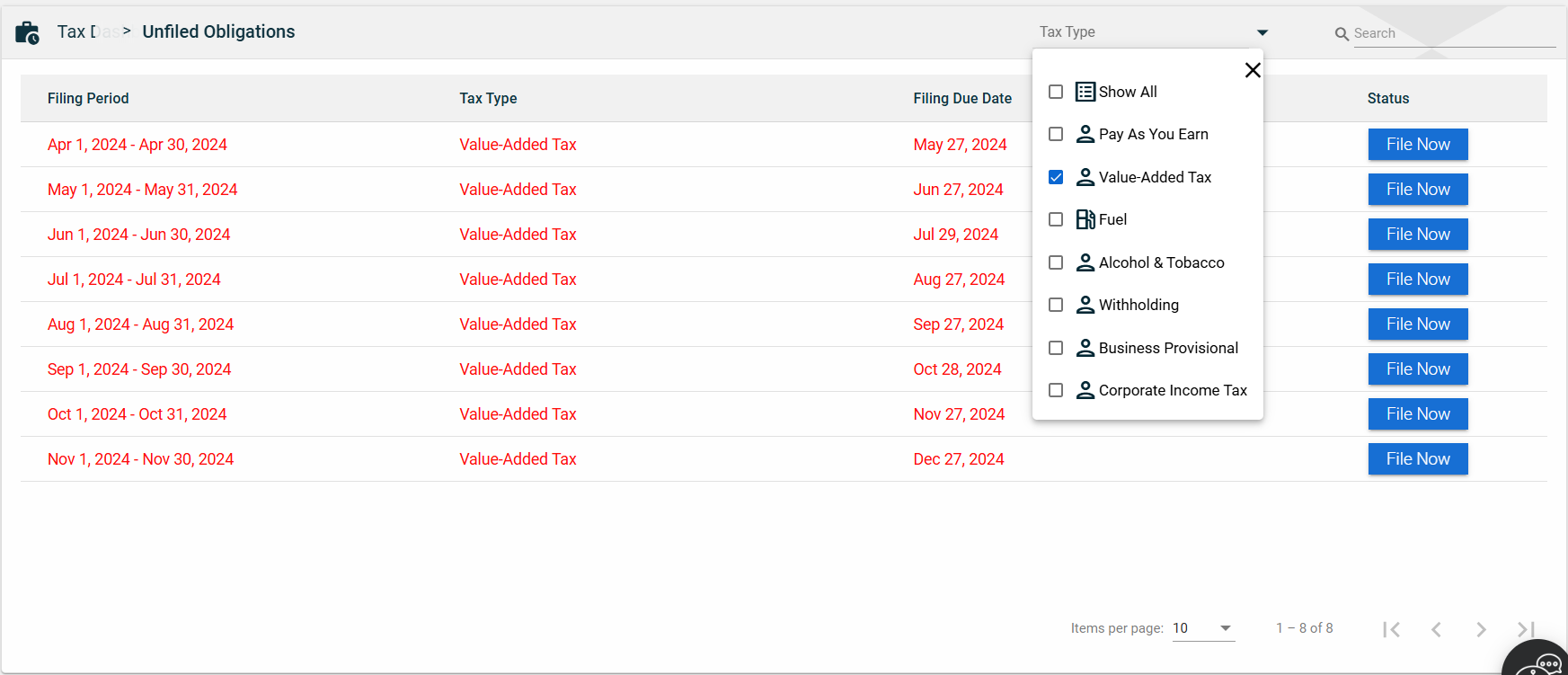

Filter

Filter the unfiled obligation items by selecting one or multiple tax types from the Tax Type dropdown.

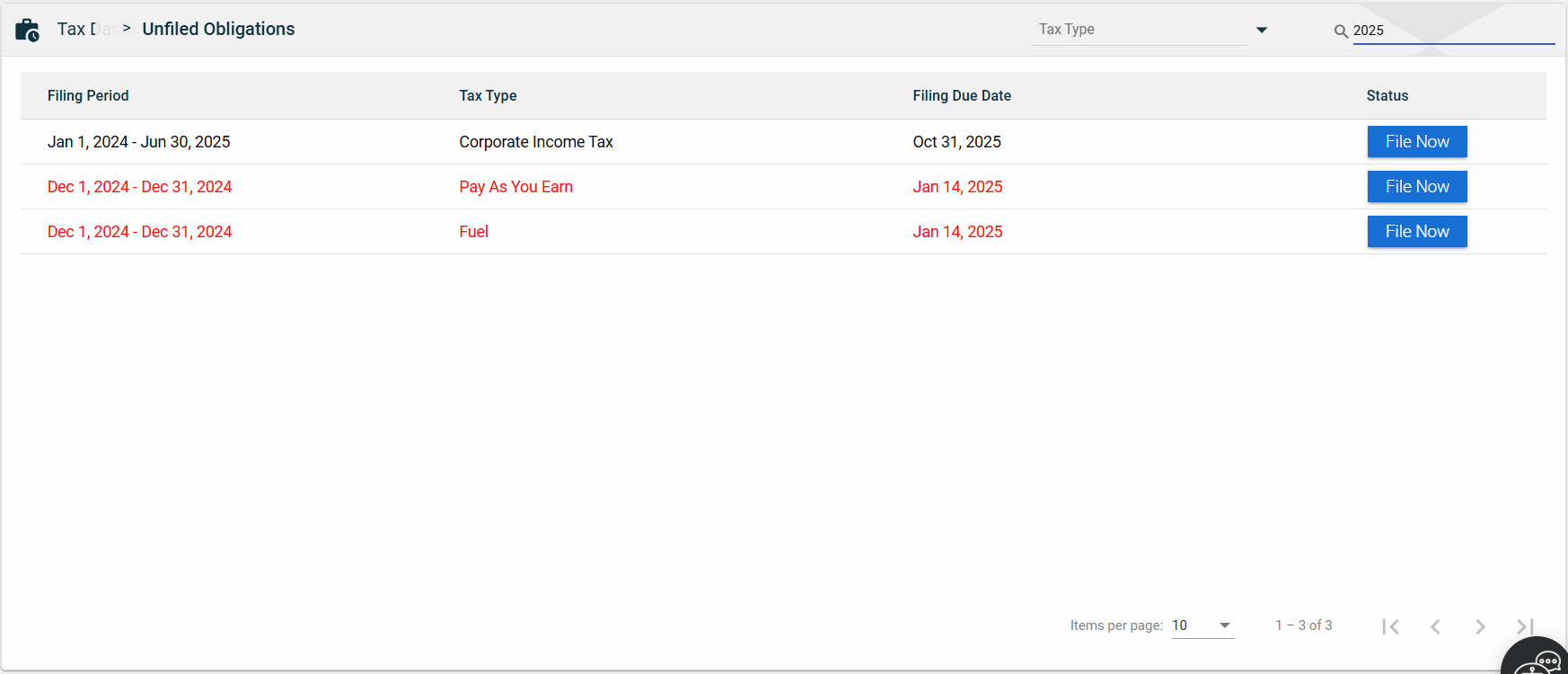

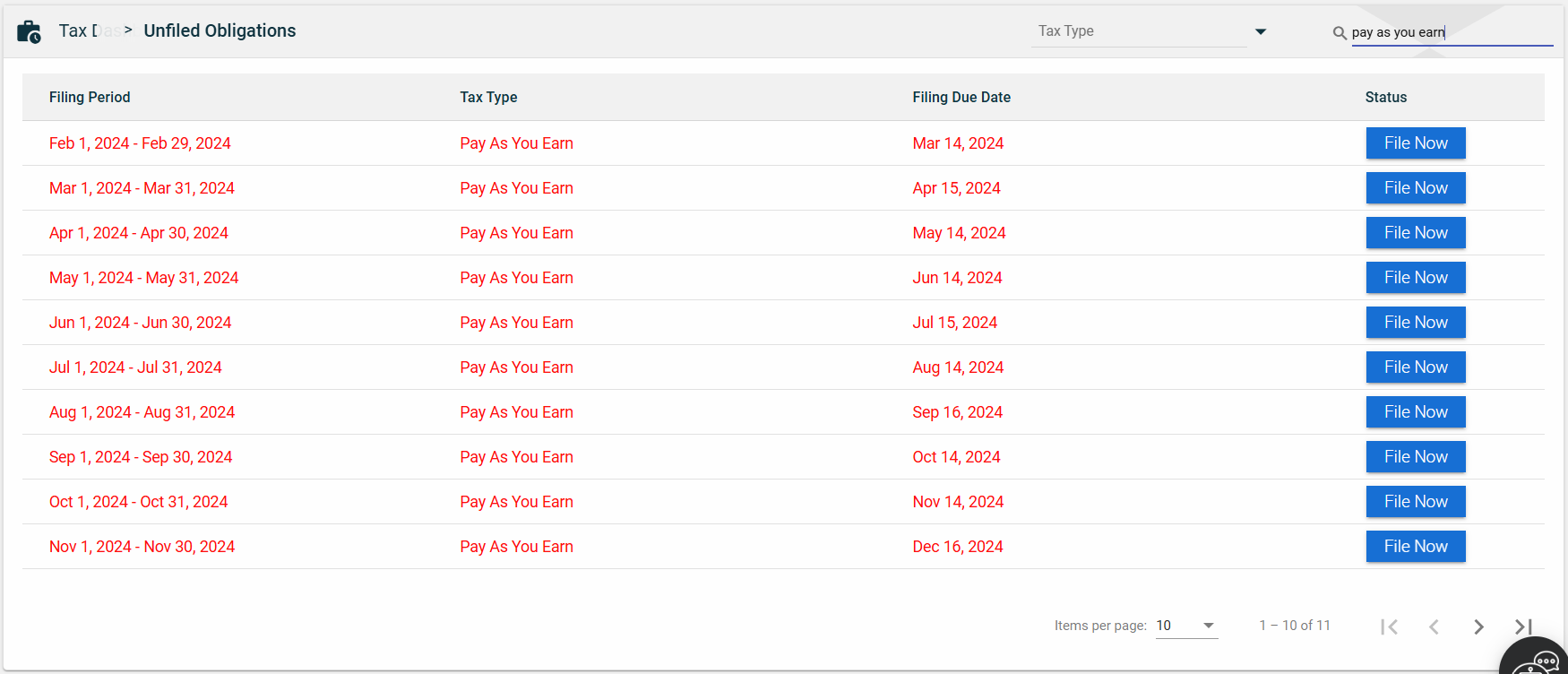

You can also search for an obligation by entering a valid year or tax type in the Search textbox.

-

Year

-

Tax Type

Sort

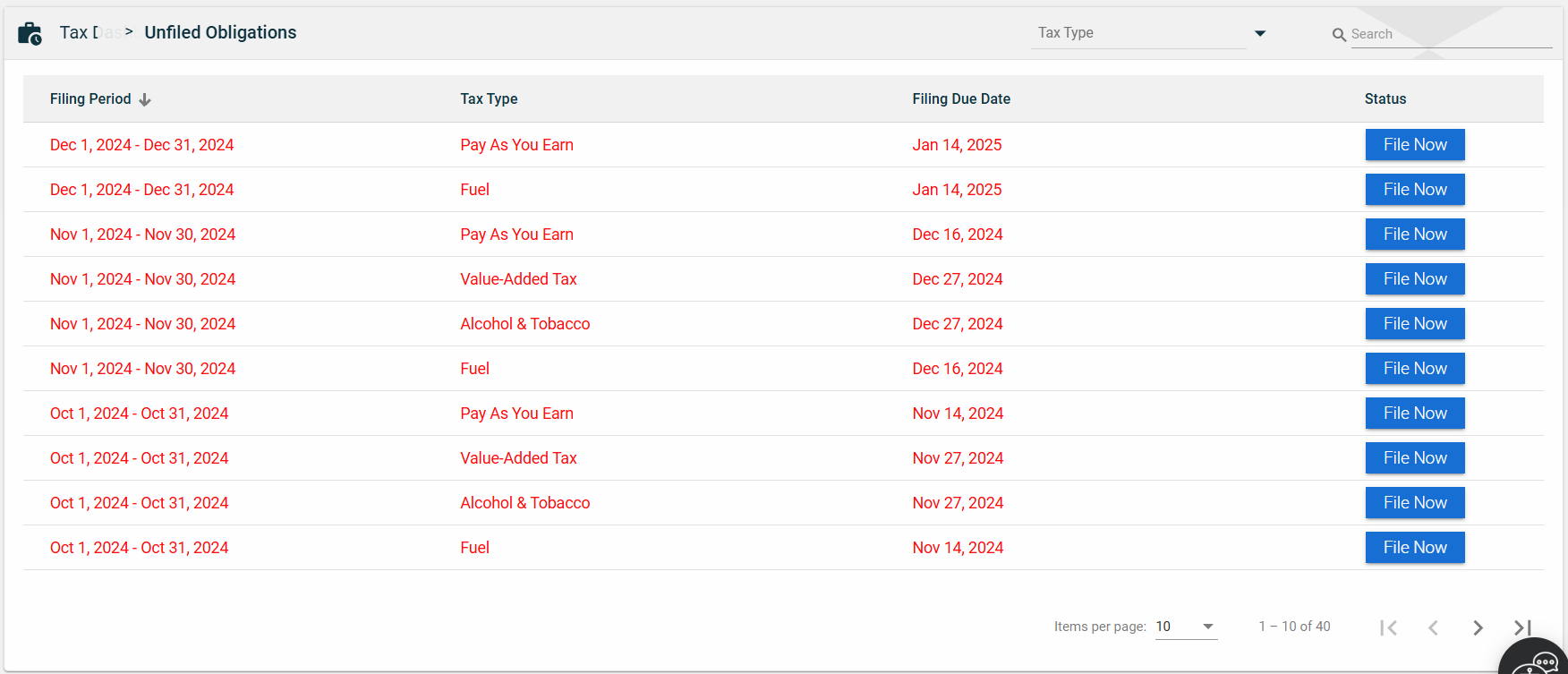

The Unfiled Obligations page allows you to sort the following columns:

-

Filing Period

-

Tax Type

-

Filing Due Date