Account Statement

Overview

The Account Statement serves as a comprehensive financial record for the selected Tax Identification Number (TIN) on the TIN selection page. It lists the financial transactions of the TIN, including all tax return figures, tax assessments, adjustments, and payments made. This document can be used as a reference for reviewing the financial history of the TIN at a glance.

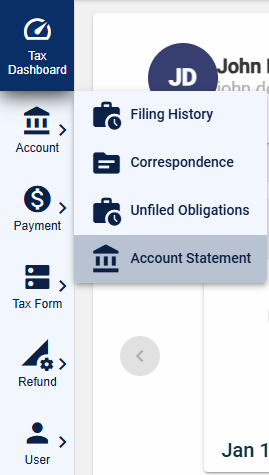

To access the Account Statement page, navigate to Account > Account Statement.

View

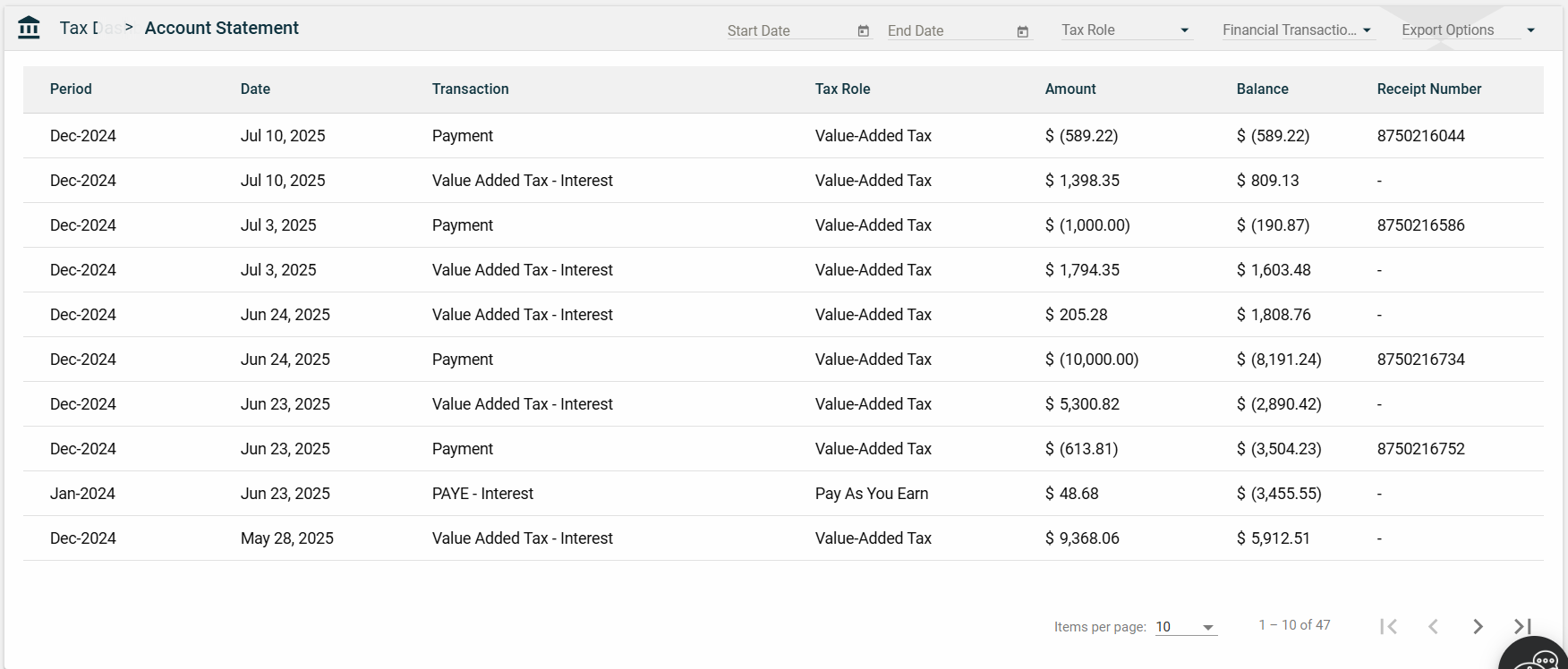

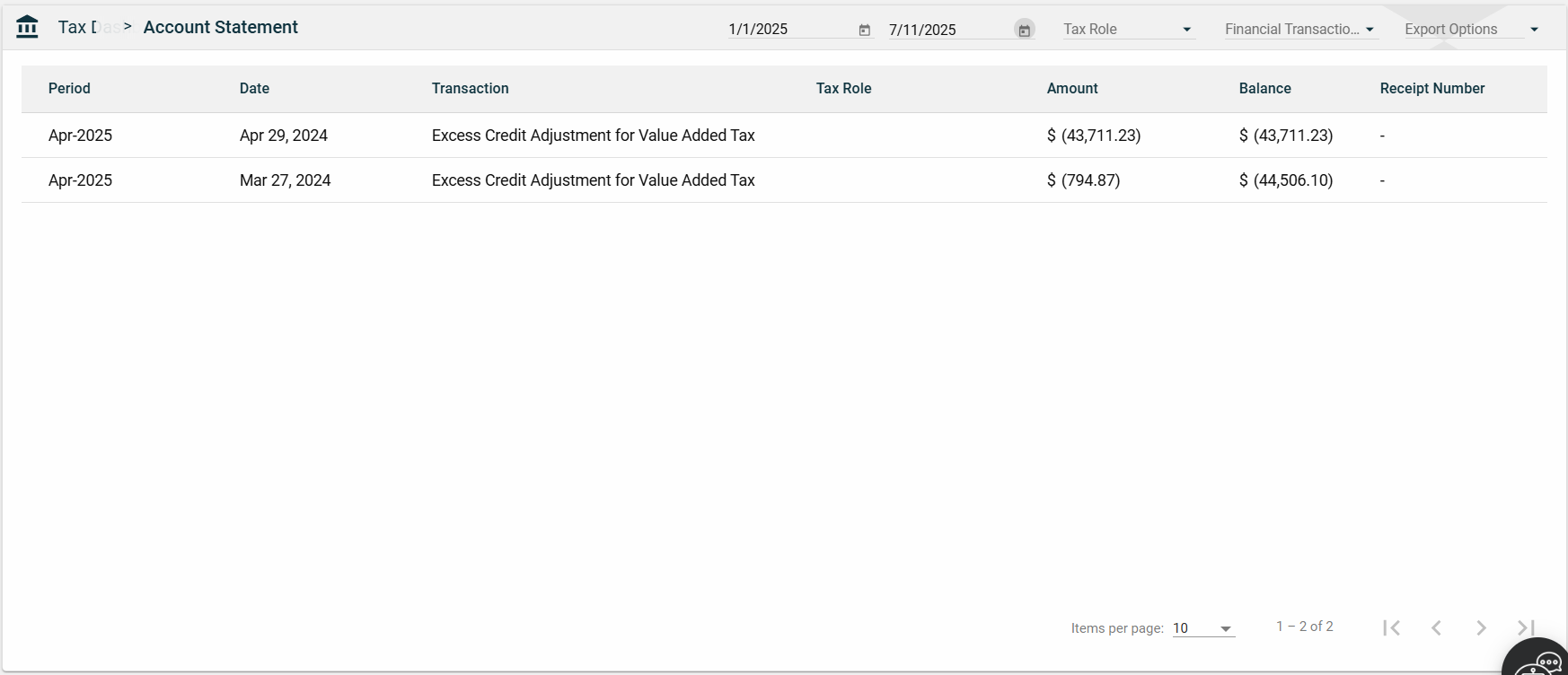

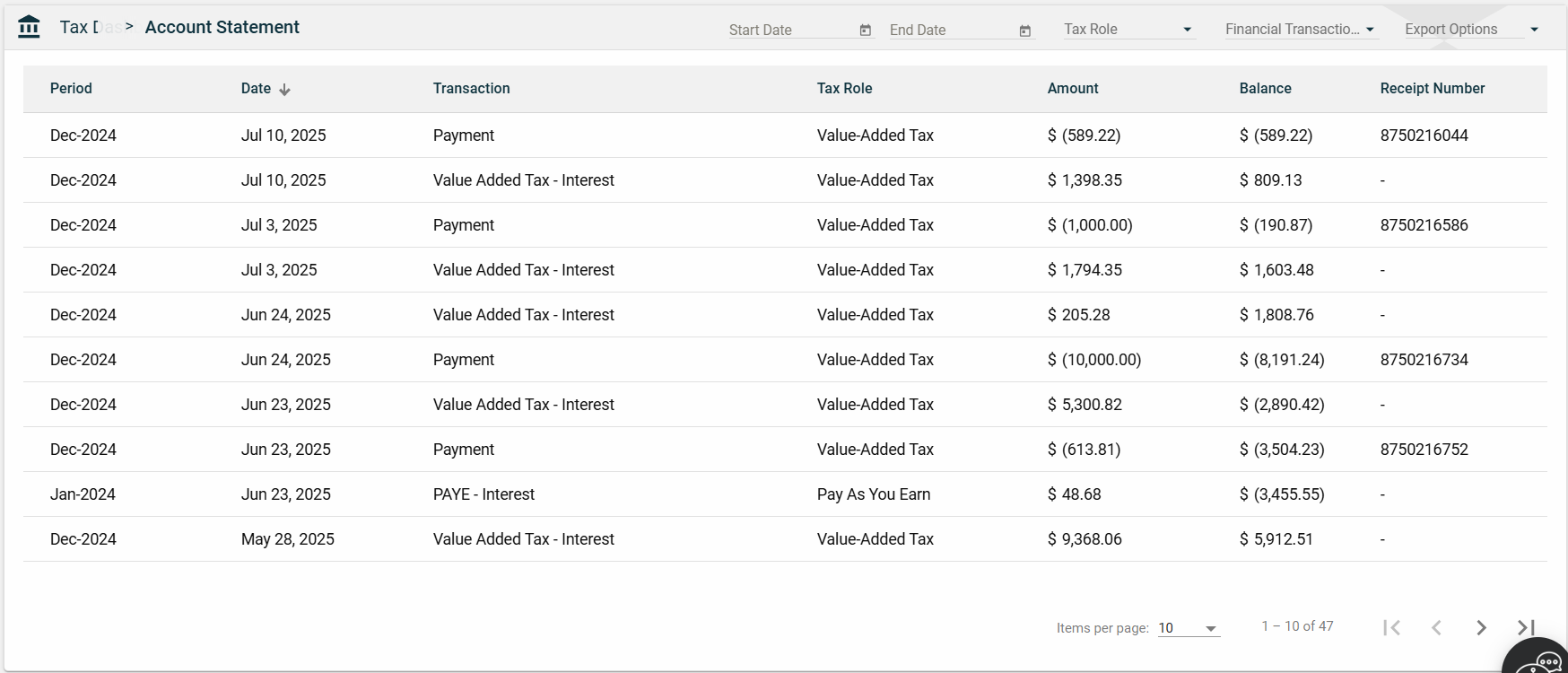

All the tax return financial transactions associated with the selected TIN are displayed in a tabular form.

| Field | Description |

|---|---|

| Date | Date when a financial transaction was made. |

| Transaction | Type of the financial transaction. |

| Tax Type | Tax type associated with the financial record. |

| Amount | Total amount that you have already paid in the financial transaction. |

| Balance | Total balance left after paying the Amount. |

| Receipt Number | Receipt number associated with the financial transaction. Only Payment transactions will have a Receipt Number.

|

Export

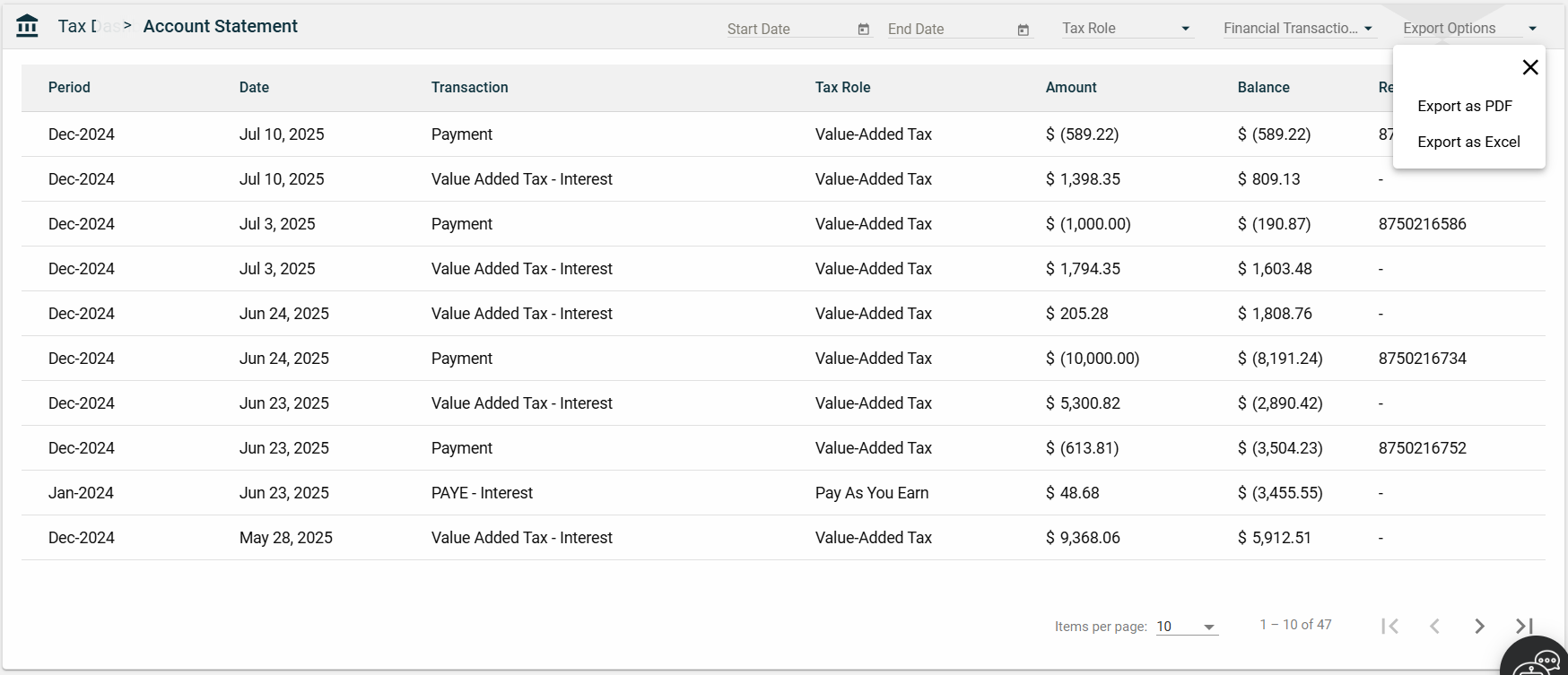

To export your account statement to an Excel file, follow these steps:

-

Click Export Options > Export as Excel.

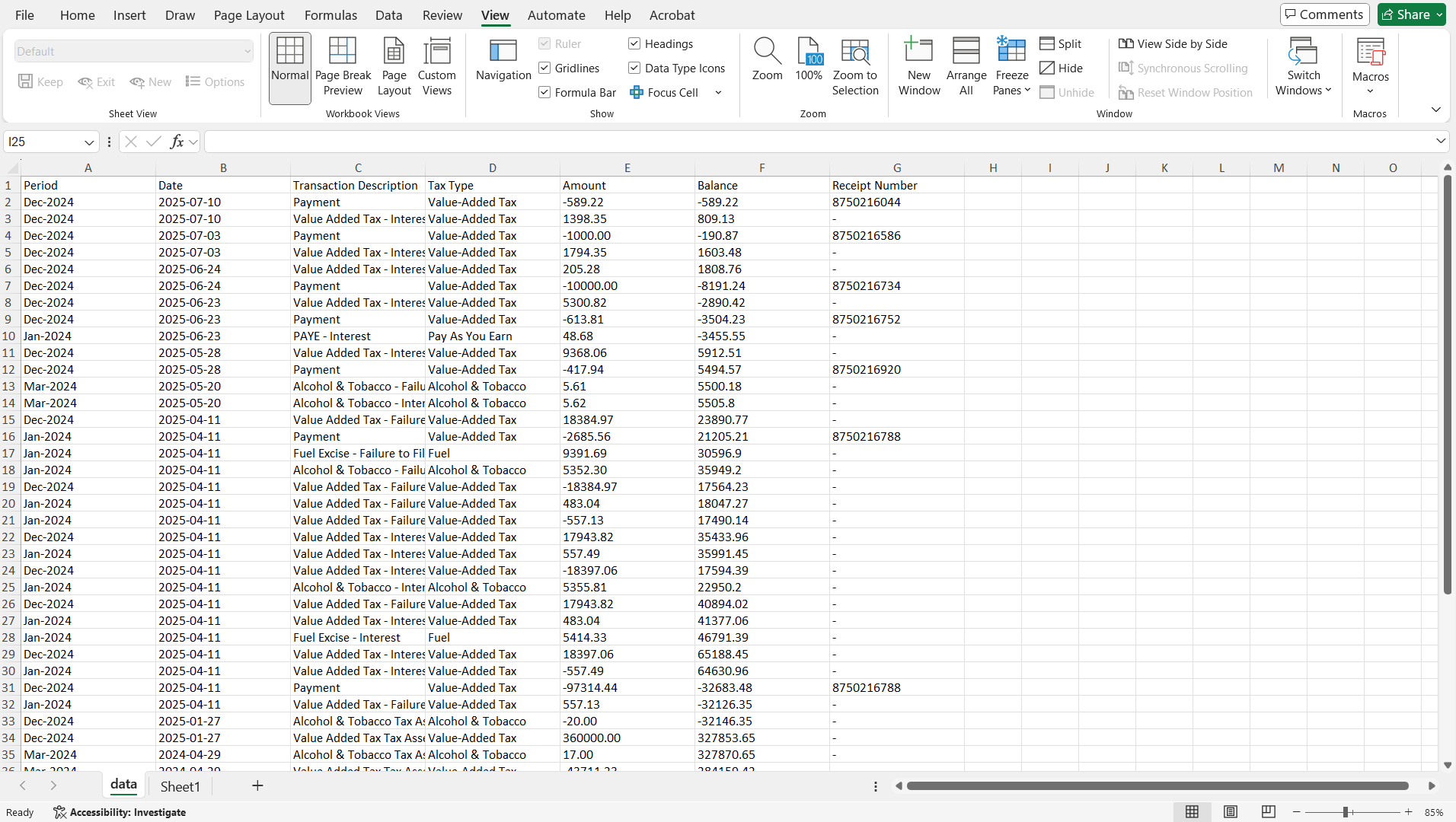

-

An

Account_Statement.xlsxfile is automatically downloaded. -

Open the file. The file displays additional columns providing more information for the financial transaction.

Filter

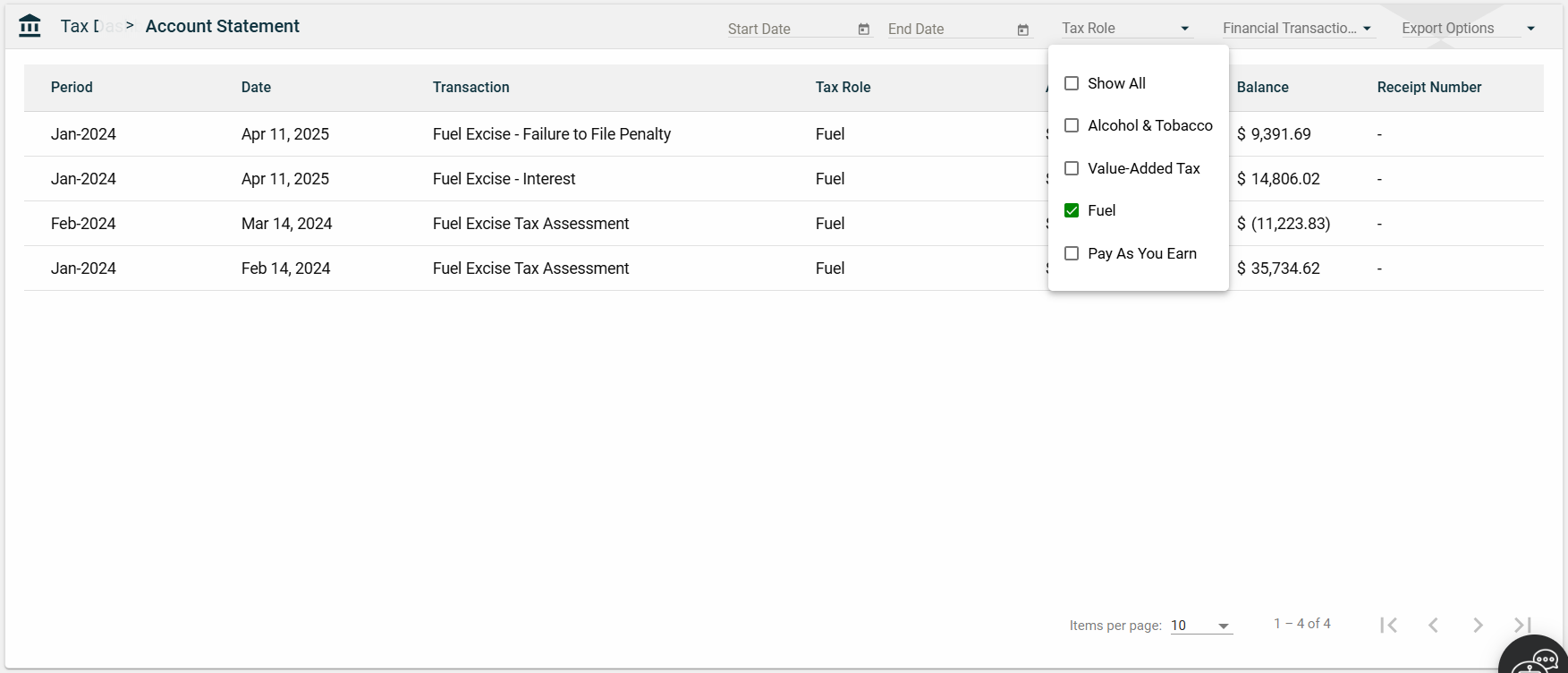

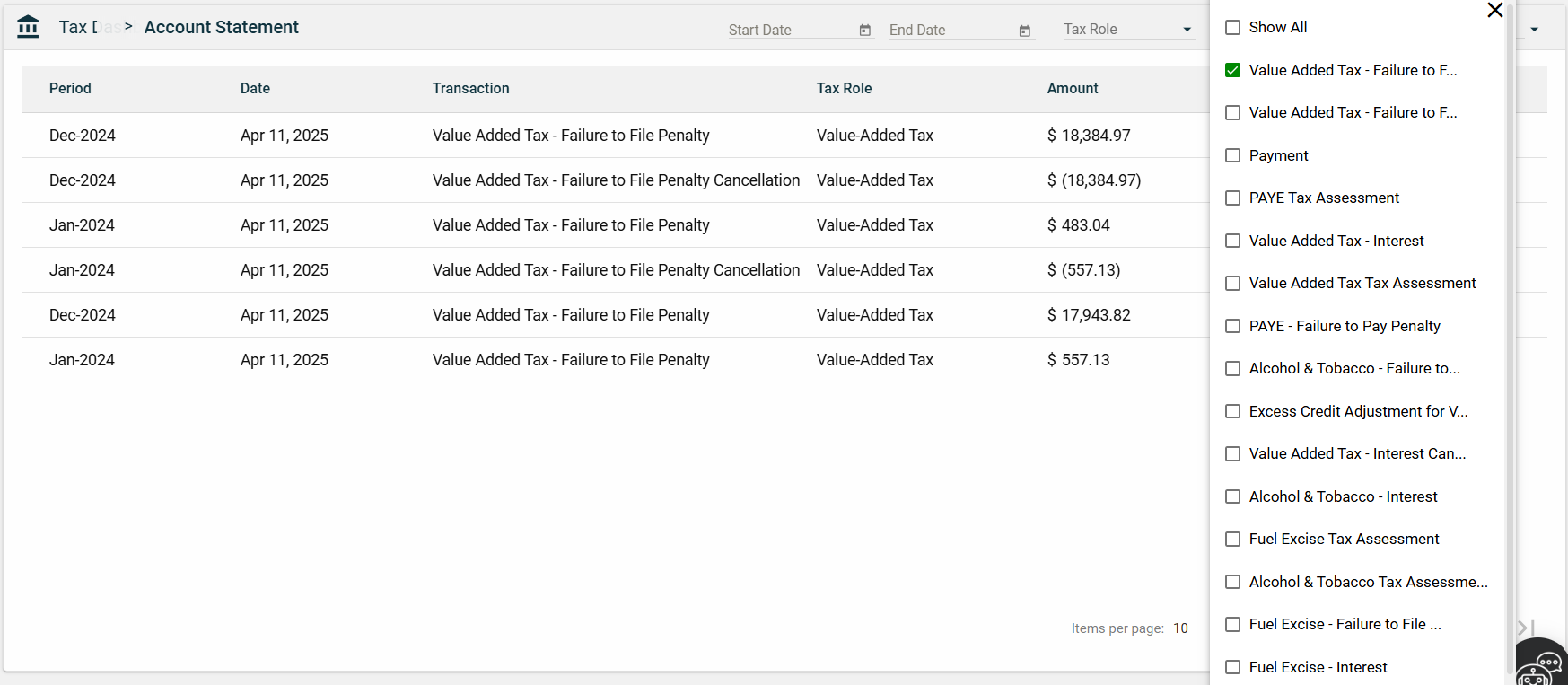

The Account Statement page allows you to filter transactions by dates, tax type, or financial transaction type.

To filter the items by date, enter a valid date on the Start Date and End Date fields.

To filter the items by tax role, select one or multiple tax roles in the Tax Role dropdown list.

To filter the items by transaction type, select one or multiple transaction types in the Financial Transaction Type dropdown list.

Sort

The Account Statement page allows you to sort the following columns:

-

Date

-

Transaction

-

Tax Type

-

Amount

-

Balance

-

Receipt Number